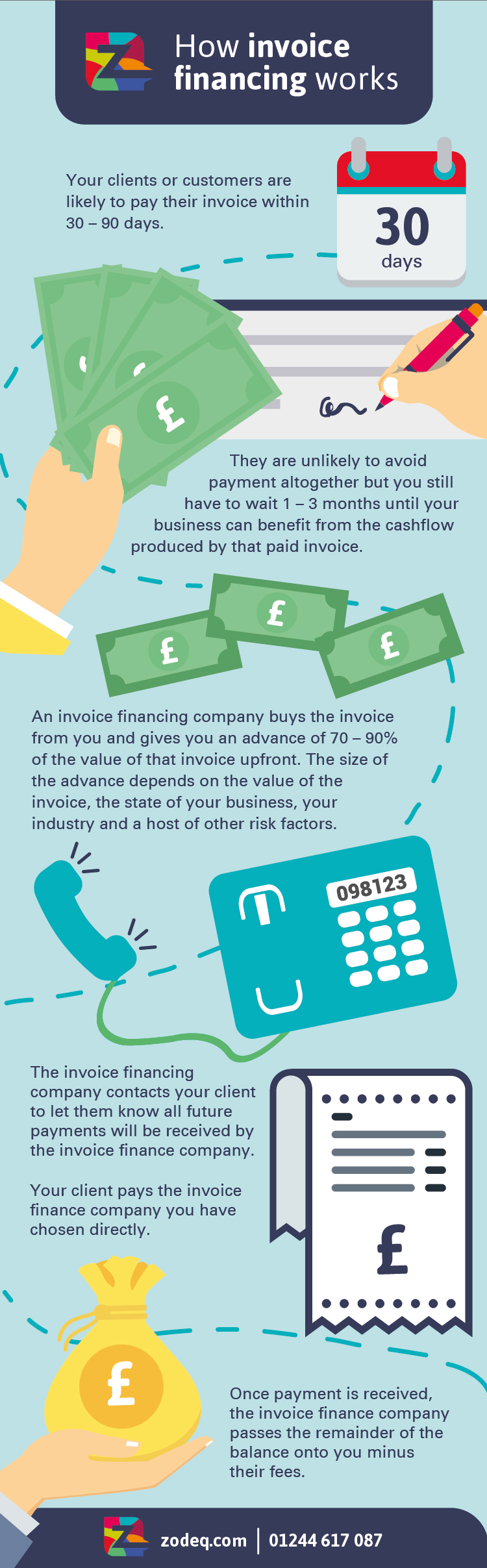

Cash flow is essential for every business however, some businesses struggle to maintain positive cash flow due to lack of time to chase invoices, which leads to financial struggles as they are paid late by clients that haven’t been chased. Whilst other businesses need cash flow to remain constant throughout the month and cannot wait for the 30-90 days that it may take for their invoice to be paid.

Recruitment businesses are often a good example of the necessity of consistent cash flow, particularly those that offer temporary placements. This is because recruitment companies often pay temp workers weekly, but only invoice the clients once a month, therefore cash flow will almost definitely be impacted.

This is the point at which invoice financing can be extremely beneficial for a business. An invoice financing company will purchase the invoice from your company as soon as it has been raised and provide you with an advance of 70-90% of the invoice value. This advance is calculated by a number of factors including:

- Value of the invoice

- Financial position of your business

- The industry in which your business operates

- A number of other risk factors

After you have been paid the advance from your invoice, the invoice finance company will step in and handle the rest; meaning, they will contact your customers to chase for payment and your client will pay the invoice finance company directly.

Once the invoice finance company has been received from your clients, you will then be passed the remainder of the invoice balance (minus service fees).

Invoice financing is a realistic and effective solution to ensure positive cash flow within a business, here at Zodeq we work with many different industries that benefit from this service, such as:

- Recruitment

- Engineering

- Construction

- Warehousing & distribution

- Haulage

- Printing

Our clients find many benefits from this service, not only from improved cash flow but also: we do not tie our clients into long term deals and there is significantly reduced credit control time as we chase for payment on your behalf, therefore you are free to focus on other areas of your business.

Are you considering invoice financing for your business? Get in touch today and see how our services could benefit your business